Bruddah IZ

DA

It seems like every Democrat in the country plans to run against Trump in 2020, and presumably, all of them will feel compelled to issue manifestos outlining their policy agendas.

This gives me lots of material for my daily column. I’ve previously written about statist initiatives from Bernie Sanders and bizarre ideas put forth by Elizabeth Warren.

Today, let’s review the two big ideas that have been unveiled by Kamala Harris, the senator from California who just announced her bid for the White House.

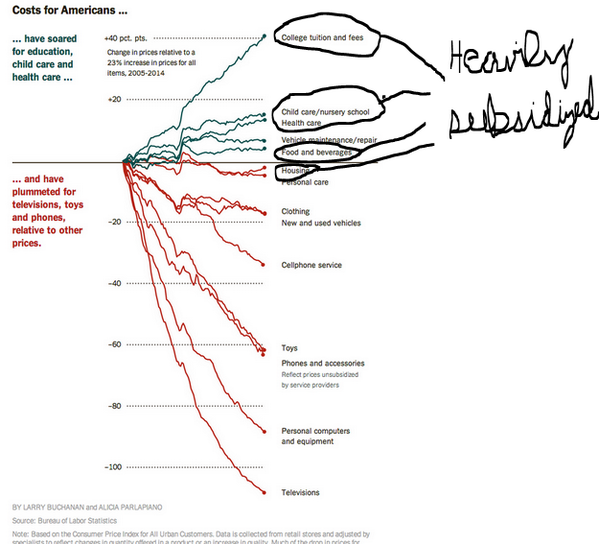

We’ll start with her idea to create a federal subsidy for rent payments. I wrote about this new handout last year and warned that it would enrich landlords (much as tuition subsidies enrich colleges and health subsidies enrich providers).

Here’s some of what Professor Tyler Cowen wrote for Bloomberg about the proposal:

One of the worst tendencies in American politics is to restrict supply and subsidize demand. …The likely result of such policies is high and rising prices, restricted access and often poor quality. If you limit the number of homes and apartments, for example, but give buyers subsidies, that is a formula for exorbitant prices. That is what makes early accounts of Senator Kamala Harris’s economic plans so disappointing. …Consider Harris’s embrace of subsidies for renters, as reflected by her recent sponsorship of the Rent Relief Act of 2018. Given the high price of housing in many parts of the U.S., it is easy to see why the idea might have appeal. But the best and most sustainable way of producing cheaper housing is to build more homes and apartments. The resulting increase in supply will cause prices to fall… That is basic supply and demand, with supply doing the active work. The Harris bill, in contrast, calls for tax credits to renters. …There is an obvious problem with this approach. If you subsidize renters, that will push up the price of apartments. Furthermore, economic logic suggests that big rent increases are most likely in those cases where the supply of apartments is relatively fixed, a basic principle of what is called “tax incidence theory.” In sum, most of the gains from this policy would go to landlords, not renters.

This gives me lots of material for my daily column. I’ve previously written about statist initiatives from Bernie Sanders and bizarre ideas put forth by Elizabeth Warren.

Today, let’s review the two big ideas that have been unveiled by Kamala Harris, the senator from California who just announced her bid for the White House.

We’ll start with her idea to create a federal subsidy for rent payments. I wrote about this new handout last year and warned that it would enrich landlords (much as tuition subsidies enrich colleges and health subsidies enrich providers).

Here’s some of what Professor Tyler Cowen wrote for Bloomberg about the proposal:

One of the worst tendencies in American politics is to restrict supply and subsidize demand. …The likely result of such policies is high and rising prices, restricted access and often poor quality. If you limit the number of homes and apartments, for example, but give buyers subsidies, that is a formula for exorbitant prices. That is what makes early accounts of Senator Kamala Harris’s economic plans so disappointing. …Consider Harris’s embrace of subsidies for renters, as reflected by her recent sponsorship of the Rent Relief Act of 2018. Given the high price of housing in many parts of the U.S., it is easy to see why the idea might have appeal. But the best and most sustainable way of producing cheaper housing is to build more homes and apartments. The resulting increase in supply will cause prices to fall… That is basic supply and demand, with supply doing the active work. The Harris bill, in contrast, calls for tax credits to renters. …There is an obvious problem with this approach. If you subsidize renters, that will push up the price of apartments. Furthermore, economic logic suggests that big rent increases are most likely in those cases where the supply of apartments is relatively fixed, a basic principle of what is called “tax incidence theory.” In sum, most of the gains from this policy would go to landlords, not renters.